Go back to the 1990’s when Haddaway released the absolute banger “What is Love?” and the concept of managing risk in investment portfolio’s felt simpler. Back then, the concept of a 60/40 equity bond portfolio was strong and remained so for around 30 years.

Simply put, when equities fell, bonds stayed strong.

However, fast forward to 2024 and the situation feels very different. The huge correction seen in the gilt and bond markets across the world put a different spin on what risk and true diversification really is and we find ourselves asking, “What is Risk?”

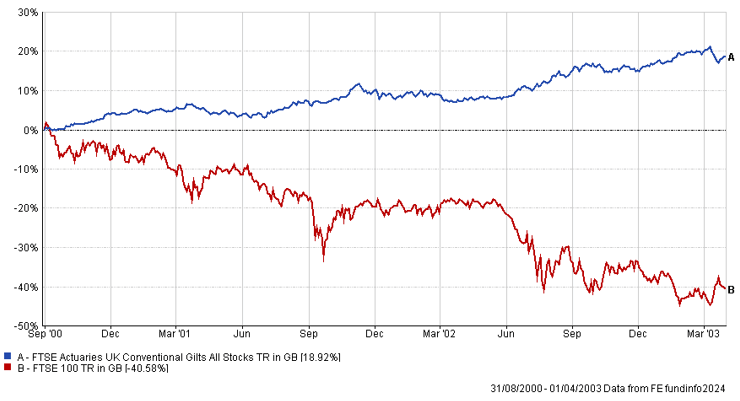

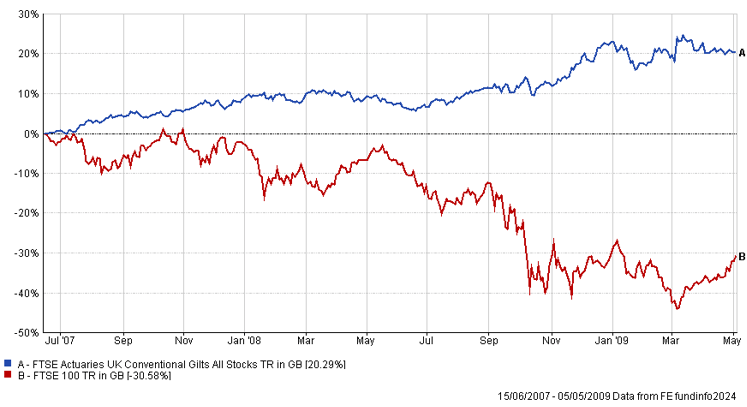

Take the FTSE 100 and UK Gilt market over the two most significant market crashes of the century:

The Dot Com Bubble – 2000/2003

The Global Financial Crisis – 2007/2009

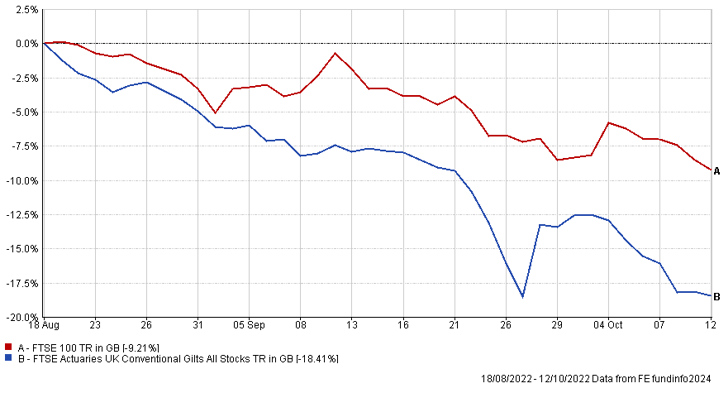

In the UK, some choice political calls and what was a volatile and reactive investment market, saw September 2022 see the most significant fall in UK gilts, it seems, ever.

Whilst we don’t have data going back to the inception of the gilt market in the 1600s, there isn’t a year on record that saw worse gilt returns.

More importantly, whilst these gilts were falling at this time, so were equities…

FTSE 100 vs. UK Gilts – Aug 2022–Oct 2022

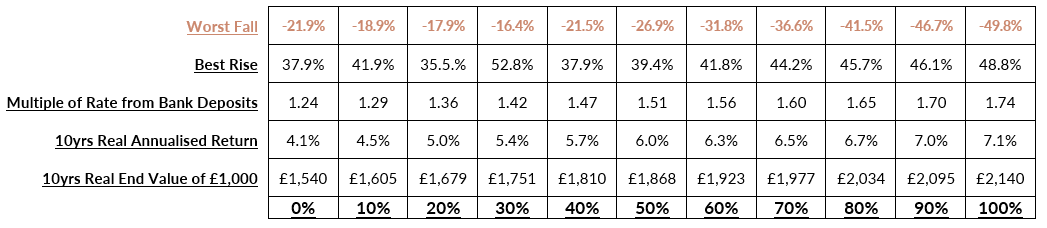

That unusual set of circumstances has consequently given rise to a new and tough to (initially) comprehend set of risk data.

Our risk provider, Finametrica, provides historical data across a set of theoretical risk managed portfolio structures. The image below shows the ‘Worst Falls’ of the past ~60 years. The effects of 2022 now mean that portfolios holding between 0% and 30% equity, show that the worst falls are now higher for “lower risk” portfolios than the “higher risk” portfolios, i.e. the trend has inversed.

Meaning the lower equity, the worst return – the opposite of what is supposed to happen.

Historical Portfolio Performance for FinaMetrica’s Illustrative Portfolios

When we consider the implications of this, the ‘lifestyling’ funds of many workplace pension schemes, feel woefully unprepared for such a scenario. We pity the investors approaching retirement in those schemes, keeping their lifelong savings ‘safe’ by transitioning fully to UK gilts in the years up to retirement.

It is the concept of risk management that, whilst gilts have always been seen as a “safe” asset, index-based investment solutions have been marketed and distributed as adding diversification benefits.

As professional advisers, we consider not just the ups and downs of portfolios (i.e. volatility), but more importantly, the effect on income withdrawal strategies, gifting possibilities, long-term growth requirements, emotional reactions and, ultimately, understanding the true objectives of any investment our clients make.